|

Weak food security highlights all of the major problems of the modern world non-order. Economic and financial nationalisms threaten. There is talk of currency wars, national management and regulation of banking, and growing demand for greater levels of trade protection. And all of these issues are inter-connected.

The discussion of monetary policy is especially divisive. Because of low interest rates in the United States, major financial institutions can borrow cheaply in dollars and then chase much higher returns in the major emerging-market countries.

The result creates an impossible dilemma for many of the world's most dynamic economies. If they try to clamp down by raising domestic interest rates, they will only attract greater capital inflows. If they let the exchange rate rise, they might deter some capital inflows, but they would also penalise their exporters and push up domestic unemployment. Emerging-market policymakers in big countries such as Brazil, China, and Turkey routinely attack the US and its monetary policy as a source of inflation, social tension, and political instability.

The most obvious and dangerous consequence of low interest rates in the major industrial countries is their impact on commodity prices, which is especially pronounced for food and fuel. As many economists, notably Jeffrey Frankel, have shown, prices on these markets are established by an auction-like process; as a result, commodity markets transmit the effects of monetary expansion particularly quickly. By contrast, branded products, into which producers have sunk major investments in securing the market, have prices that are much stickier and do not reflect the effects of monetary policy as rapidly.

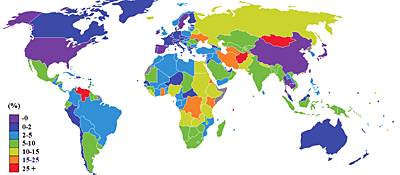

WORLD INFLATION RATE 2010 |

This should be a happy picture: the world is now better able to feed itself. But the same economic stimuli that underpin higher food output also lead to supply problems, a decline in living standards, and massive social strains, especially in urban centers.

This is important to bear in mind, because rising food prices have historically been the trigger for political revolutions. The three revolutions that made the modern world, in France, Russia, and China, all had their immediate origins in food shortages, fear of hunger, and disputes about food pricing.

The panic about bread that swept France in 1789, and the inability of the government to guarantee supplies, destroyed the ancient regime. Louis XVI was contemptuously called "le boulanger," the baker. Wartime inflation destroyed stability in the Russian empire in 1917, as farmers, worried about the declining value of their money, hoarded their output and let the cities starve. The Bolsheviks came to power on a promise of bread (and peace). China, too, was paralysed by inflation after the Second World War, leaving it vulnerable to food panics.

Food prices are usually not limited in their effects to one country alone. Simultaneous revolutions swept Europe in 1848, in the aftermath of crop failures whose most notorious manifestation was the Irish famine. Price rises have been a major trigger of the discontent this year in the Middle East and North Africa. Though the Egyptian and Tunisian economies were expanding quite satisfactorily, people had to pay much more for food.

Moreover, it would be wrong to view this as a purely regional phenomenon limited to the so-called Arab Spring. The same kind of unrest, in which the countryside is pitted against the town, with both sides demanding more rights, could undermine the political order in China and other big emerging-market economies.

Recent decades have been replete with contagious financial crises that spread disorder from one country to another. The effects of globalised money are now producing a new whirlwind. The coming years or even months are likely to see new forms of these domino effects. As in 1848, the struggle for affordable food is producing discontent that transcends national frontiers, threatens established regimes, and fuels popular demand for a more just political order.

Project Syndicate

Harold James is professor of history and international affairs at Princeton University. He is the author of The Creation and Destruction of Value: The Globalization Cycle.