There have been efforts by officials and media recently to discredit independent power producers (IPPs). This merits a response, and a need to shed light on the ground realities of private investment vis-a vis public sector undertakings in the development of hydropower resources in Nepal.

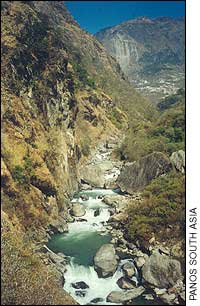

There have been efforts by officials and media recently to discredit independent power producers (IPPs). This merits a response, and a need to shed light on the ground realities of private investment vis-a vis public sector undertakings in the development of hydropower resources in Nepal. As far as the Bhote Kosi Power Company (BKPC) is concerned, we have been able to finish the project pretty much on time and within the stipulated budget despite a force majeure flood. While the license is for 36 MW, we were able to install 52 MW bringing the cost of the project to roughly $ 1.92 million per MW. This includes international project management fees, interest on money during construction, several types of insurance, international legal fees etc. The entire project including the 25 km transmission line is operated and maintained by 20 personnel.

We were never approached for hand outs. The SoalteeGroup does not condone nor participate in such activities involving graft by any name. We had the occasional request for in kind services such as building something in the area over and above the agreed responsibilities the project had undertaken for local and area development. The only request of a shady nature came from officials requesting a few more days in Korea on their way to China to inspect the equipment being manufactured, with a higher daily allowance, which of course was flatly denied.

In order to secure debt financing on the project, we approached close to 100 international banks along with International Finance Corporation (IFC) as the lead financier. Nepal simply does not feature on the international private sector infrastructure investment map. The international financial community will closely watch the performance of the BKPC and Khimti before committing any more resources in this sector for sometime. The track record on contractual obligations will determine the future of the hydropower development here in Nepal.

Hydropower may be Nepal's wealth, but we cannot develop it without foreign capital. Neither can equity or debt be raised on any project of medium size domestically. Furthermore, investors as well as the financial community have little or no experience to exercise project finance, a complex financing tool which is the norm in long term infrastructure development. Nor do we have the legal expertise in the country. We lack the project management expertise to be efficient. Insurance options do not exist here. All in all, we have no other option but accept the norms of globalisation to draw from overseas the inputs required to developing the hydropower sector.

Let us look at some of the public sector projects, the most recent being the public sector 144 MW Kali Gandaki A. The project is also financed mainly in US dollars, which had delays exceeding two years. The project cost is estimated at $435 million and perhaps will finally end up being up to $70 million higher as the contractors negotiate. This could bring the per MW cost of production to around $3 million to 3.3 million-not counting the capitalisation of interest during construction, legal fees, and insurance premiums. Add to this the level of overstaffing that would most probably be a burden on the project. For example, state-owned Sunkosi with a capacity of 10 MW employs 342 staff.

What is even more surprising is that the state utility borrows money from the government in Nepali rupees at the rate of 12 percent when in fact the government borrowed that money from multi-lateral agencies for between 1-4 percent.

The major problems inherent in the NEA are management issues such as over-staffing, weak financial controls,receipt of debtors, delay in repatriations from branches, inability to expand its distribution, transmission losses, low employee productivity, high employee to installed capacity ratio, low revenue to employee ratio, low fixed asset to employee ratio. The problem is not the PPA with independent power producers.

We would be more than happy to debate the merits and demerits of public sector undertaking vis-?-vis the private sector in an open forum. It would open the eyes of the public, which ultimately has to shoulder the burden of the NEA's perceived poor management and non-transparent practices. The high end of the per unit consumer tarriff of NEA is almost twice the per unit charge that BKPC charges NEA. Hence a 50 percent margin, an enviable contribution to any business enterprise.

(Siddhartha Rana is Executive Director and local partner in the Upper Bhote Koshi Hydroelectric Project and Chairman of the Soaltee Group).