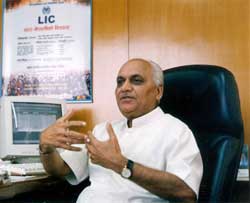

Insurance in Nepal is still in its infancy, but it has huge potential for growth. Among the big players in this fledgling sector is Life Insurance Corporation Nepal that began as a joint venture two years ago with an Indian public sector insurance company. SK Sakhuja, CEO and managing director at LIC Nepal, spoke to Nepali Times about the lack of investment opportunities, future direction and other prospects.

Nepali Times: How robust is the insurance business in Nepal?

Nepali Times: How robust is the insurance business in Nepal?

SK Sakhuja: It is virtually a virgin market, but there is a lot of potential for life insurance in Nepal. According to the 2001 census, the insurable population in Nepal is more than 12 million: these are people in the earning 15-59 age group. Considering Nepal's 2.2 percent population growth rate, there is an insurable population of 15 million. This means there is a large group who are not covered by insurance schemes.

What are the drawbacks then to serve this market?

Most people are not aware about the needs and benefits of life insurance. The upper segment have a better understanding, but the middle class and the lower strata are unaware about insurance, especially in rural areas.

We have a mixed clientele: businessmen, service holders, even a few outside major towns and cities. The average size of our insurance policy is Rs 170,000 and that includes some policies between five to 10 million. Our minimum sum is Rs 10,000 under a policy, and the endowment plan of Rs 20,000 under the money-back plan. This ensures that even the poor can take out an insurance policy. Another thing I am happy to report is that last year we sold 24 percent of our policies to women.

Is the business getting competitive?

In a competitive market, all players have to compete, that is not a problem.

We follow sound financial practices, ethics, ground rules, corporate governance rules and the law of the land. Our vision is to be an organisation of social and economic significance to the country. This financial year, we did 9,177 policies over the first premium income of Rs 70 million and a total sum insured of Rs 1.4 billion. This compares very favourably to last year, and we are among the top companies.

But is your success partially due to some others floundering?

I cannot comment on that, but I can only say that five years down the line, LIC Nepal will be the number one life insurance company in this country. We are very aggressive and are targeting rural areas and all 58 municipalities.

Has the political instability and insurgency benefitted insurers?

As far as political instability is concerned, we don't get into all that. My worry is that the country's economic growth has been hampered. We have been unable to invest the premiums we have. The problem is the lack of longterm investment avenues. If those were in place, we could have introduced innovative products and offered better returns to policy and stakeholders. Today, most of the money goes into bank deposits for a few years because there are almost no investments that span a 10-year period. This is very awkward when the average term of our policy is 15 years. Bank rates are falling and depositing funds in short-term bank deposits makes for an unprofitable mismatch. It doesn't help that certain banks refuse to accept deposits. Where can we put the money?

So where do you put your money?

We requested the Insurance Committee to float 10-year bonds and subscribed to them. We are trying to utilise all the avenues under the guidelines of the government. We also keep in mind that we are keeping the policy holders' money as trustees. We cannot play around with that.

Most insurance companies in Nepal only act as conduits between local clients and insurance companies abroad, especially India. Are we not losing income this way?

Yes, we are. In the border towns, most Nepalis have taken out insurance policies with LIC of India. I, personally, have taken the matter up with the Life Insurance Corporation corporate office in India. The chairman has instructed all neighbouring zonal and divisional offices to put an end to this practice. As a representative of LIC India, I have taken initiatives to stop the practice of getting business from Nepal. We have to remember that it's not against the law for the people here to pay the premium in Indian currency to get themselves insured. But then, that is something the government has to tackle.

How can business be improved?

One way is to create awareness about insurance, an area where the regulator also plays a vital role. We, as insurance companies, can also join hands but the regulation authority has to take the lead. My next suggestion is with regard to taxes. In a small country like Nepal where the market is not very big and the capital market doesn't have depth or longterm investment avenues, reduction of income tax rates for insurance companies is a wise move.

Is the National Insurance Committee of any use?

They are very supportive. They have been very helpful whenever we have any problems. We have been in discussions with the committee and the insurance committee has definitely played a vital role in

changes brought about in agent regulations and income tax law in the latest budget.